Global crises and ongoing macroeconomic factors like supply chain disruptions, supply shortages, and the COVID-19 pandemic continue to impact consumers around the world.

With many unknowns still up in the air, fears and tensions are growing among consumers as prices of goods rise and threats of continued inflation loom. Are consumers concerned enough to change spending habits? If so, how will the threat of rising costs impact retailers and product sellers who have been managing challenge after challenge for more than two years?

According to a recent survey from Cin7, consumers are conclusively concerned about inflation, and they’re changing their preferences towards product sellers as a result. Their primary criterion for purchasing goods is now price by a wide margin, with the survey finding that the price of goods (45%) is the most impactful factor when choosing where to buy items, followed by quality of goods (18%), online ordering capabilities (12%), geographic location (9.5%), supporting a local or small business owner (9%) and lastly, speed of delivery (7%).

The vast majority of consumers (81%) state that they’re worried about inflation. Only 22% of consumers said they’re not reducing their spending right now, meaning that it’s doubly important for sellers whose products are not considered “essential” to make their value known and do everything in their power to keep demand up even when spending is being reduced.

Consumers consider buying on price in wide margins, at the expense of smaller and local product sellers and are instead gravitating towards big box retailers – with 49% stating they’d make purchases wherever is cheapest and 26% saying they’d purchase in-store from big box retailers. The survey results suggest that consumers don’t have major qualms about shopping at big box stores – and while they are still shopping online, a growing percentage of people would cut back if supply chain issues caused prices to rise.

Convenience and location matter, as 46% of respondents claim they’d purchase from locally-owned businesses if the price of goods were the same at different stores, followed by big box retailers (40%), and online from small businesses (14%). This signals trouble for online sellers as they’ll need to ensure their customers feel it’s just as simple and convenient to shop online from them, even if they can get the same product elsewhere. Otherwise, they risk losing out to local product sellers with brick and mortar presences, as well as big box retailers who have both online and in-store presences.

Buying behavior has already shifted as consumers look to reduce spending. The top two things they’re cutting back on – going out to eat at restaurants (67%) and purchasing non-essential items like clothes and toys (65%) – are not only detrimental to local and small businesses, but also signal challenging times ahead for two industries that have been hit hard during two years of the pandemic.

As the price of goods increases globally and supply challenges continue, product sellers need to do everything they can to keep costs down. To do this, sellers must implement cloud-based technology to optimize operations to enable them to focus on better managing inventory and warehouse capabilities to keep up with fluctuating demand, accurately forecast and plan for the future, gain end-to-end visibility and more. This will be critical to fight the supply chain headwinds that are driving costs up and margins down.

Sellers also need to do everything they can to expand their sales channels with the help of integrated inventory and order management technologies – nearshoring product where it makes sense to get items into consumer hands quicker and outsourcing to third-party logistics (3PL) providers to compete with big box retailers who hold a lot of power in terms of addressing the warehouse and labor shortages impacting sellers today.

Find out how Cin7’s inventory and order management solution cuts operational overhead allowing you to price your products competitively. Let a Cin7 consultant show you how workflow automation and ready integrations with over 700 major retailers, online marketplaces, ecommerce sites, and 3PLs reduce costs. Request your free demo here.

The primary goal of any retail business is to attract and retain customers. Learn how to attract customers to your store with these tips.

What is retail in this day-and-age? eCommerce has changed the landscape so quickly, it may be difficult for small or new businesses to see how or if a physical store fits in their strategy. Yes, the customers are out there and they continue to shop in store more than online, at least for the time […]

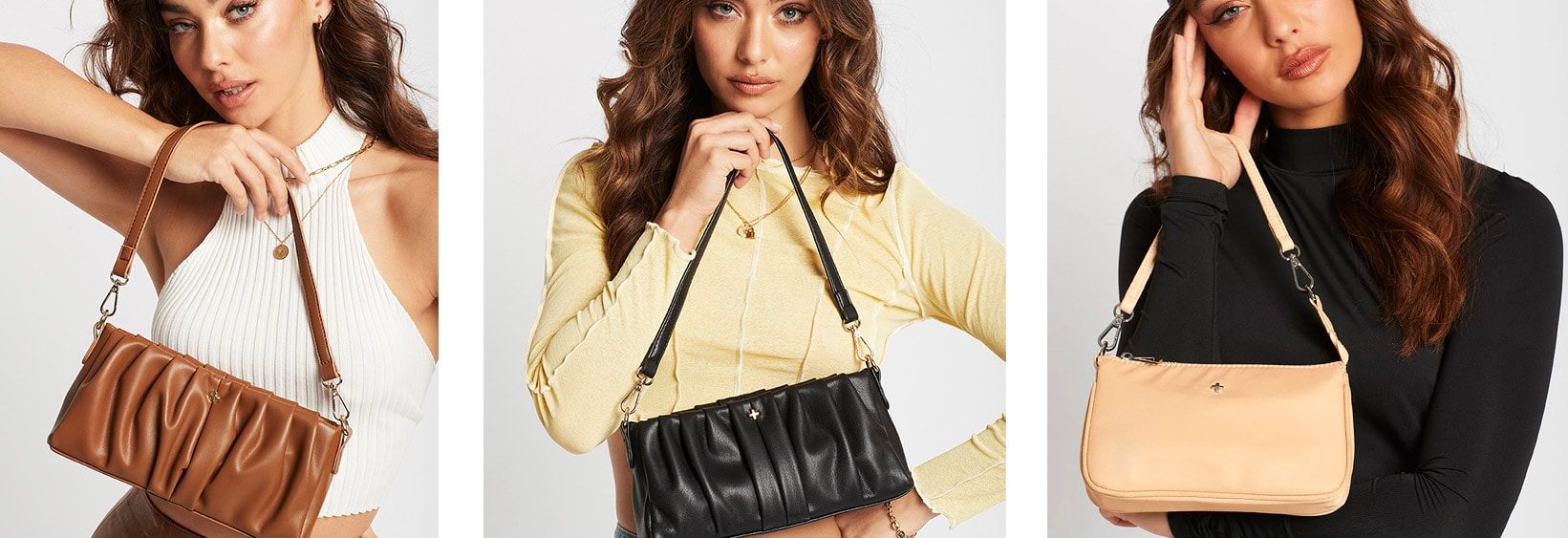

Jennifer Xidias on how Cin7’s inventory management integrations saves Peta+Jain time and hundreds of thousands of dollars, every year. One of the most quantifiable things in my decision to go with Cin7 as my software choice was not only its futuristic focus, but also the amount we could save on our IT spend. Most […]